A sudden surge in homeowner insurance adjustments and evolving risks in property protection have forced service professionals, including locksmiths, to reexamine their coverage. This article weaves together industry studies, expert insights, and recent state statistics to offer a detailed look at how locksmiths in Texas can protect their businesses and clients. For instance, increasing claim denials in Texas homeowner insurance have raised concerns for various professionals, making it crucial to invest in the right kind of coverage. Learn more about these emerging challenges by considering insights from the Insurance Council of Texas.

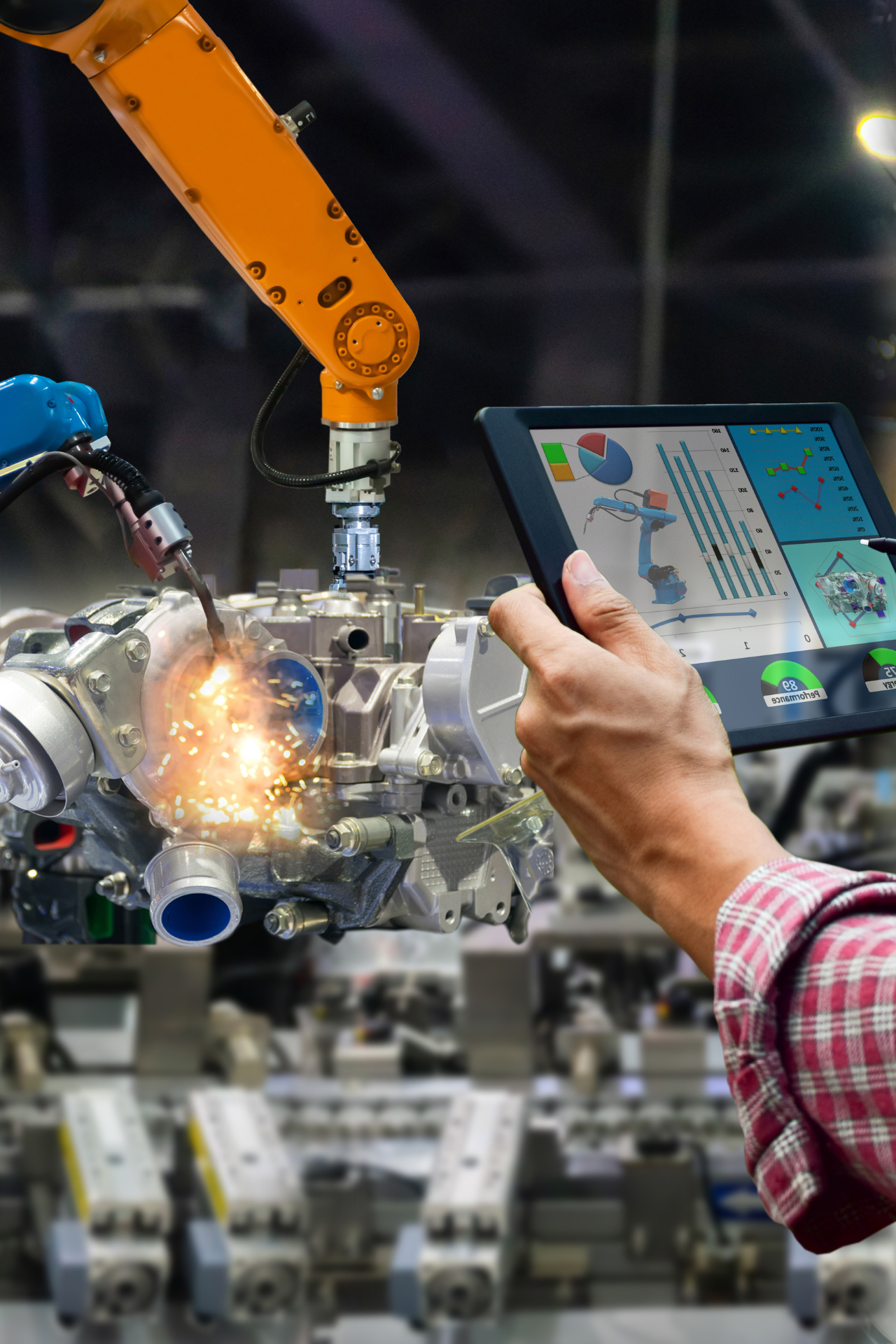

The locksmith industry has traditionally been viewed as a niche market, but rising technological integration and digital lock systems have shifted the industry’s landscape. Amid these changes, market data, such as a projected growth of 20% compound annual growth rate (CAGR) for smart lock systems, reinforces the need for updated insurance policies that reflect modern risks. This discussion provides a comprehensive guide for locksmiths who need to secure both their physical operations and digital innovations.

With both financial liabilities and safety risks growing, it is imperative to know what your insurance policy covers, its limitations, and how evolving market trends impact policy pricing and claim handling. The following sections break down key components of locksmith insurance, relevant risks in Texas, and strategic considerations to ensure business security.

Understanding Locksmith Insurance Needs

Locksmiths face unique challenges that call for custom-tailored insurance solutions. The field covers various services, from installing smart locks to emergency access and repair, each with distinct risk profiles. Because a single mistake in the field can easily lead to significant financial liability, comprehensive coverage is more than advisable-it’s essential.

Liability issues can stem from both physical damage during service calls and potential breaches caused by compromised digital systems. With the expansion of digital security, locksmiths must consider risks associated with smart lock installation. As GV Lock points out, expanding expertise in digital security and smart technology is now a critical aspect of maintaining competitiveness. The updated nature of modern risks means that policies must closely align with current technological advancements.

The right insurance package should ideally cover property damage, data breaches, and professional liability claims. In practice, this means combining general liability coverage with professional liability and cyber risk policies. Tailoring these coverages to the unique circumstances of a locksmith’s work environment can help mitigate financial setbacks stemming from both human error and the unpredictable nature of emerging technologies.

Risk Factors and Liability Concerns

Risk factors in the locksmith industry extend beyond the immediate scope of a service call. A malfunction in a smart lock or errors in handling customer data can lead to significant compensation claims. As the locksmith business increasingly integrates digital systems, vulnerabilities in cybersecurity can lead to even more complex liability issues. An insurance package that combines both physical and cyber risks is crucial for minimizing these exposures.

Locksmiths often operate in unpredictable environments; one moment they are installing high-tech security systems, and the next they might be called to manage emergency lockout situations. The rapid pace and variety of work expose them to personal injury claims, property damage, and cybersecurity breaches. For instance, if a locksmith inadvertently damages a property while installing a system, comprehensive liability coverage can cover ensuing legal fees and repair costs, ensuring that the business continues to function despite adverse claims.

It is essential to factor in the overall increase in insurance claim challenges observed in Texas. Recent data from the Insurance Council of Texas indicates that nearly 47% of homeowner insurance claims closed without payment have raised alarm bells about how claims are being handled

(ICT). These figures underline the broader market trends that may eventually impact how locksmith claims are processed and settled by insurance companies.

Key Coverage Components for Locksmiths

Locksmiths require policies that not only reflect the multitude of risks inherent in their work but also integrate safety nets for emerging vulnerabilities. One key component is general liability insurance, which covers bodily injuries or property damage that could occur during routine service operations. This type of insurance often forms the cornerstone of a robust coverage plan.

Another critical element is professional liability coverage. This helps protect against claims of error or negligence. With rapid technological changes, a mistake in installing or maintaining smart lock systems can have far-reaching consequences. Rich Johnson, the Director of Communications and Public Affairs for the Insurance Council of Texas, has highlighted that rising deductibles may be influencing a trend of increased claim denials (ICT expert insight).

Cyber risk insurance rounds out the coverage needs for modern locksmiths. A breach in digital security, such as unauthorized remote access or data leakage from high-tech locks, needs specialized insurance support. This addition not only offers protection against the direct costs of data breaches but also covers reputation management and potential litigation expenses.

Homeowner and auto insurance trends in Texas reveal a landscape of rising premiums and increased claim denials, which could spill over into related industries. In 2023, Texas homeowner insurance claims showed that 47% of claims were closed without payment (Insurance Council of Texas statistic). This can be partly attributed to tougher underwriting standards and increasing deductible amounts.

Another layer of complexity is added by the recent surge in insurance premium costs. The Texas Department of Insurance reported that in 2023, auto insurance rates increased on average by about 25.5% and homeowners rates by about 21.1% (TDI report). Although these figures directly pertain to homeowners and auto policies, similar upward trends are observable in commercial and specialized services, including locksmith coverage. Insurance providers are recalibrating premiums based on broader risk patterns, meaning that locksmith insurance premiums may also see adjustments in the near future.

Tariffs on essential building materials, as noted in research from Insurify, suggest that annual premiums for homeowners insurance in Texas might reach as high as $6,718 by the end of 2025

https://members.insurancecouncil.org/ap/EmailViewer/rZoA18Np. For locksmiths, indirect market pressures like these may inspire similar adjustments in risk assessment models by insurance companies, ultimately influencing premium pricing strategies.

Impact of Fraud and Insurance Fraud Developments

Fraudulent claims have a significant impact on how insurance companies underwrite risks and determine premiums. For example, in October 2025, Trinity Couriers Inc. pled guilty to fraudulently obtaining workers’ compensation insurance coverage and agreed to pay restitution to Texas Mutual Insurance Company (Texas Department of Insurance). Although this incident does not directly involve locksmiths, it underscores the broader environment of cautious underwriting practices that affect all niche insurance markets.

The repercussions of fraudulent behaviors ripple across the industry, often leading companies to raise deductibles or tighten claim verification processes. This careful approach affects all sectors, including locksmith services, and necessitates that business owners remain vigilant in choosing reputable insurance providers. Ensuring accurate customer data and maintaining high operational standards can further diminish the likelihood of being subjected to increased premium rates over time.

Locksmiths should consider insurers that reward transparency and strict compliance with industry standards. A comprehensive policy not only covers genuine risks but also includes safeguards against fraudulent practices. Such measures ensure that in the unfortunate event of a claim, the process is straightforward and timely.

Adapting to Technological Advances

Locksmith businesses are in a period of rapid transformation. Advances in smart lock technologies and digital access systems have opened new avenues for service delivery but also introduced unique risk scenarios. Modern locks are often vulnerable to hacking attempts or software malfunctions. This intersection of physical and digital risk mandates a dual approach to coverage.

Insurance policies are evolving to address these multifaceted challenges. Cyber liability coverage now often encompasses risks specific to networked security devices. In an era where an error in digital implementation can lead to massive security vulnerabilities, having a policy that explicitly addresses technology-related risks provides essential financial and legal support. Providers are increasingly tailoring cyber coverage to align with operational realities, ensuring that claims are processed swiftly in case of cybersecurity breaches.

Looking ahead, the smart lock market is expected to reach about $2.5 billion by 2025, highlighting the pressure on professionals to adopt smarter systems

(ABQ Just In Time Locksmith). As clients become more technologically savvy, the insurance needs of locksmiths also evolve, necessitating updated policies that extend traditional coverage to include advanced digital risks.

| Policy Type | Coverage | Average Annual Premium | Key Benefits |

|---|---|---|---|

| General Liability | $500,000 bodily injury & property damage; $1,000,000 annual aggregate | $670 | Covers third-party claims; protects against damages during operations |

| Workers' Compensation | Covers medical and wage-related expenses for employee injuries | $1,710 | Ensures employee safety net; legally required and critical for workforce protection |

| Additional Coverages | Optional: Pollution, Product Liability | Varies | Provides extra layers of protection; covers cleanup and environmental claims |

A balanced insurance plan for locksmiths must integrate traditional coverage with modern, technology-focused options. Traditional coverages, such as general liability and property damage, remain essential. They protect against common issues encountered during service calls, such as accidental property damage or injuries on the job. These basics provide a safety net in cases where simple, non-digital mishaps occur.

Modern coverages, especially those addressing cyber risks, have grown significantly in importance. As locksmiths install and service smart locks, they become increasingly responsible for cybersecurity. A breach involving a high-security system can result in both legal consequences and loss of customer trust. Integrating comprehensive cyber liability coverage into an overall policy package is a wise move that aligns with the emerging realities of the trade.

This comprehensive approach reduces the gaps that might be exploited in the event of an incident. It helps secure not only the physical integrity of property and assets but also the digital integrity that modern systems depend on. Insurance companies are now better equipped to offer packages designed specifically for multi-dimensional risks, allowing locksmiths to operate securely in both the physical and digital realms.

Practical Steps to Enhance Coverage

Locksmiths can take several practical steps to ensure that their coverage is both comprehensive and cost-effective. First, it is essential to engage with an insurance broker who understands the unique risks in the locksmith industry. By analyzing the specific operations of a locksmith business, brokers can tailor policy recommendations that address key exposure areas.

Regular reviews of existing policies are also critical. As technology and industry standards evolve, insurance needs change accordingly. A policy that perfectly fit six months ago might now have gaps in cybersecurity coverage or misalign with new risk profiles. Consistent updates and consultations with industry experts ensure that the most relevant coverages remain in place.

Investing in additional training on digital security and technology can also reduce premium costs. Insurers may offer discounts or lower deductibles for businesses that demonstrate proactive safety measures. Clear documentation of training, certifications, and adherence to industry best practices can serve as leverage when negotiating premiums or coverage modifications.

Insurance Pricing Considerations Specific to Texas

Texas presents a unique insurance market where trends in homeowner and auto coverage often signal broader shifts in premium pricing. The aggressive stance taken by underwriters in Texas in recent years is evident in various segments of the insurance market. For instance, rising deductibles and a growing percentage of claims being closed without payment can influence how coverages for different professions are underwritten (ICT statistic).

Locksmiths operating in Texas benefit from paying close attention to these trends. While specific premium rates for locksmith coverage might not always directly mirror homeowner or auto insurance figures, similar pricing dynamics can be expected. Factors such as claim frequency, the severity of incidents, and even market conditions like material tariffs factor into pricing models. In a scenario where tariffs on building materials drive up insurance premiums, business owners need to anticipate potential cost increases and budget accordingly (Insurify study).

Insurance providers in Texas are actively aligning their risk assessment models to account for these pressure points. As such, possessing a comprehensive understanding of both market trends and improvements in risk management can help locksmiths navigate an increasingly complex insurance environment.

Balancing Operational Costs with Insurer Demands

Locksmith businesses, like many service-based professions, are continually striving to balance operational expenses with the demands set forth by insurance underwriters. Insurers often factor in unique elements of the locksmith trade, such as the frequency of emergency call-outs and the inherent risks of handling high-tech equipment. As premium costs rise, there is a delicate balance between maintaining competitive service pricing and ensuring adequate insurance coverage.

Keeping expenses in check requires proactive measures. It involves incorporating regular risk assessments and investing in preventive measures such as staff training and state-of-the-art security tools. Transparency and proper documentation of risk management practices not only improve operational safety but also help in negotiating better premium rates with insurance providers.

This balancing act is further complicated by broader market factors, such as the increased claim denial rates seen in other sectors. For example, when homeowner claims in Texas have escalated to nearly 47% being closed without payment

(ICT statistic), it sets an industry-wide precedent that insurance companies consider when assessing risk profiles. A locksmith operating in such an environment must ensure that their practice of meticulous documentation and adherence to safety practices is well communicated to insurers during policy renewals.

Case Studies and Lessons from the Field

Examining real-world scenarios provides valuable insights into how comprehensive coverage has saved businesses from costly setbacks. In one illustrative case, a locksmith encountered significant legal and financial challenges after an improperly installed smart lock resulted in unauthorized access. The comprehensive insurance package in place helped cover legal fees and repair expenses, ultimately preserving the business’s reputation and financial stability. Such cases underscore the intrinsic value of a well-rounded insurance plan.

An incident in another service segment reveals how rising claim denials and higher deductibles can strain even well-managed businesses. A local contractor, facing an unexpectedly high deductible layered on a denied claim, was forced to re-evaluate the insurance package to better align with emerging risk profiles. While not a locksmith example per se, the scenario amplifies the need for professionals in all sectors to thoroughly understand policy terms. This insight is especially crucial for a field that now straddles both physical and digital risks, as highlighted by industry experts.

These examples also point to the importance of clear communication between the service provider and their insurer. Detailed record keeping, documented safety protocols, and periodic policy reviews are not just administrative overhead-they are practical measures that translate to real financial and operational resilience. By drawing lessons from such case studies, locksmiths can better prepare for unexpected events and continuously adapt to market shifts.

Tools and Resources to Evaluate Coverage Options

There are a number of resources available to help locksmith professionals assess and refine their insurance strategies. Online comparison tools and broker consultations allow service providers to juxtapose different coverage packages, ensuring that they get the optimal balance between cost and protection. Tools that compare general liability, cyber risk, and professional liability coverage side by side generate better transparency and reduce the likelihood of redundant coverage.

Analytical resources from trusted industry experts, including detailed reports from the Texas Department of Insurance, provide a context-specific backdrop to pricing and coverage trends. For example, the TDI reported significant premium hikes in auto and homeowners insurance in Texas (TDI report), a data point that guides commercial and niche insurers in crafting more specialty-targeted products. Such insights help ensure that locksmiths are not overpaying for coverage while remaining protected against modern risks.

Regular consultation with insurance professionals that specialize in small business covers is recommended. These experts can provide bespoke advice based on local factors, ensuring that the chosen policy not only meets standard industry benchmarks but is also geared to address climate, economic, and technological risks prevalent in Texas.

Frequently Asked Questions

Q: What types of insurance coverage are essential for locksmiths?

A: It is critical to secure general liability, professional liability, and cyber risk policies to address both traditional and digital threats that arise in daily operations.

Q: How do rising deductibles impact locksmith insurance costs?

A: Increased deductibles generally mean higher out-of-pocket expenses in the event of a claim, as seen in industry data reported by the Insurance Council of Texas (ICT), which may result in meticulous policy evaluation.

Q: Is cyber liability coverage really necessary for locksmiths?

A: Absolutely. Modern locksmiths now install smart locks and handle digital systems, so cyber liability coverage protects against breaches and software malfunctions that could lead to severe operational disruptions.

Q: How can locksmiths keep their premiums affordable while maintaining adequate coverage?

A: Regular policy reviews, risk management improvements, and transparent documentation of operational safety measures are key strategies to potentially negotiate better premiums.

Q: Can evolving market conditions in Texas affect locksmith insurance coverage?

A: Yes. Market trends, such as rising claim denial rates and increased deductibles noted in Texas homeowner insurance, may also influence the structure and pricing of locksmith insurance policies.

Q: What role do external market factors like tariffs play in determining insurance premiums?

A: Tariffs on building materials can indirectly raise premiums, as studies indicate upward trends in homeowners insurance costs which can reflect in the pricing models used by insurers for specialized services as well.

Wrapping Things Up

Locksmith insurance coverage in Texas is a dynamic field influenced by both technological innovations and evolving market risks. A balanced insurance package that integrates general liability, professional liability, and cyber risk is crucial for safeguarding businesses. Rising deductibles, changing claim practices, and broader economic pressures all contribute to shaping the landscape in which locksmiths operate.

Staying informed through reliable resources such as industry reports and expert insights is key. Using data from organizations like the Insurance Council of Texas and the Texas Department of Insurance provides a firm grounding in understanding these shifts. Adopting proactive measures, including regular policy reviews and investing in training on digital security, further strengthens business stability in this fast-paced environment.

Ultimately, locksmiths who prioritize understanding emerging risks through continual education and strategic insurance planning are better equipped to manage unforeseen liabilities. Whether on a routine service call or handling advanced digital installations, having the right coverage not only protects the business but also builds trust with customers who increasingly demand professional and secure operations.

About The Author: Mark Braly

As President & CEO of Braly Insurance Group, I’ve built my agency since 1997 on the promise of protecting what matters most for families and businesses across Texas.

With a finance degree from Oklahoma State University and nearly three decades in the industry, I lead a team that offers tailored, local insurance solutions—whether it’s specialized commercial coverage or personal protection.

Outside the office, you’ll find me on the golf course or playing piano, always energized by time with my family and my commitment to giving back through organizations like CASA McKinney.

Testimonials

Real Insurance Clients with Honest Reviews

Braly agency was very honest and professional to work with. They have many resources to choose from and are a full service Insurance Agency. I highly recommend! Caden provided excellent and knowledgeable service throughout the process.

Louis G.

Insurance Client

I have been with the Braly Group for years. Their attentiveness gratitude and all around a good group to take care of your insurance and others needs.

Thanks for being amazing,

Jeff D.

Insurance Client

I have been with the Braly Insurance Group for over 10 years! Absolute professionals who definitely take care of you personally. I trust the Braly Group to give me the best product and price for my insurance needs!

Doug F.

Insurance Client

Everyone at Braly Insurance is always friendly & helpful. Whether you need to file a claim or make changes to your policy they are there to help with whatever you need.

Terry B.

Insurance Client

Business Insurance

Commercial Insurance Policies

General Liability Insurance

Comprehensive protection against lawsuits and other common business risks.

Workers Comp Insurance

Coverage for medical expenses and lost wages due to workplace injuries.

Commercial Property Insurance

Protect your business property from damage, theft, and natural disasters.

Commercial Auto Insurance

Insurance for vehicles used in your business operations, covering accidents and damages.

Professional Liability Insurance

Protection against claims of negligence, errors, and omissions in your professional services.

Industry-Specific Insurance

Businesses We Serve

FAQs

Frequently Asked Question About Braly Insurance Group

What's the difference between an independent insurance agent and a captive agent?

Independent insurance agents, like those at Braly Insurance Group, offer a wide range of insurance products from multiple companies, allowing them to compare policies and find the best fit for your needs. Captive agents are tied to a single insurance company and can only offer products from that provider. Choosing an independent agent in Texas provides access to a broader selection of options, ensuring a more personalized and cost-effective insurance solution.

Why should I choose an independent insurance agent in Texas?

Opting for an independent insurance agent in Texas means receiving personalized, unbiased advice across a wide spectrum of insurance options. Independent agents source policies from multiple companies, tailoring coverage to your specific needs, often at more competitive prices. They possess a thorough understanding of local insurance requirements and risks, ensuring your coverage is both comprehensive and relevant to Texas.

What are the typical insurance types offered by independent agents in Texas?

Independent agents in Texas typically provide a broad range of insurance types, including homeowners, auto, life, and umbrella policies, as well as specialized coverage like motorcycle and condo insurance. They offer customized solutions for various situations, ensuring you have access to policies that match your specific needs, whether you're protecting your family, home, vehicle, or personal assets.

What's the cost to collaborate with an independent insurance agent in Texas?

Engaging with an independent insurance agent in Texas usually doesn't involve any direct costs or fees for their advisory services. Agents earn commissions from the insurance companies for the policies they sell, allowing you to benefit from their expertise and personalized service without incurring additional expenses. Their objective is to secure the best coverage for you at the most competitive rates, aligning with your financial and insurance needs.

Why should I partner with a local independent insurance agent?

Partnering with a local independent insurance agent offers numerous advantages. They have a profound understanding of Texas' unique insurance needs and challenges, providing advice and solutions tailored to the local context. Local agents are readily available for face-to-face meetings, offering a level of personalized service that larger, non-local agencies can't match. Their commitment to the community means they're dedicated to finding the best insurance solutions for their neighbors, adding a personal touch to their professional services.

Personal Insurance options

Our Complete Range of Personal Insurance Solutions

Home Insurance

Protect your home with comprehensive coverage tailored to your needs. Secure your peace of mind today.

01

Car Insurance

Drive confidently with our customizable auto insurance plans designed for every driver and vehicle.

02

Boat Insurance

Enjoy your time on the water with our reliable boat insurance, covering damages and liabilities.

04

RECENT POSTS

Get the Latest Updates

Contact Us