Texas tow truck operators and towing companies face unique challenges in an environment where market dynamics, regulatory shifts, and litigation trends intersect. When truck accidents and lawsuit pressures rise, the insurance coverage landscape becomes even more complex. This article delves into key components of Texas tow truck and towing insurance while offering practical insights for service providers navigating risk, coverage needs, and litigation climates.

Recent industry reports, such as those from the

Texas Department of Insurance, have highlighted trends in the commercial auto liability market. Such data sets the stage for a deep look into the factors influencing coverage rates and risk assessments in a state known for its robust transportation sector.

Understanding the Unique Risks for Tow Truck Operators

Tow truck operators in Texas encounter a broad range of risks. Accidents involving commercial trucks are frequent, with more than 35,000 incidents reported in 2025 alone, averaging nearly 98 accidents per day, as noted by industry research from McKay Law PLLC (). This high occurrence rate creates a challenging liability environment.

Insurance providers assess both operational scenarios and litigation trends. The increasing lawsuit filings, driven by complex accident dynamics and aggressive legal strategies, contribute to higher premium rates and a more cautious underwriting process among carriers. Operators must review their coverage plan and risk management strategies regularly.

The challenges are twofold: on one side is the physical and operational risk associated with towing damaged vehicles and assisting in accident scenes; on the other, the legal exposure associated with property damage claims. Each element demands a careful look at policy provisions and coverage exclusions.

Core Components of Texas Tow Truck Insurance

Liability Coverage

Liability coverage remains at the heart of any tow truck insurance policy. It provides essential protection against claims related to bodily injury or property damage resulting from accidents. Negative net worth returns recorded in markets like Texas, such as the reported -3% 10-year return for commercial auto liability insurance (), signal that profitability has been under pressure, which can in turn influence premium rates and underwriting criteria.

Given the declining profitability, carriers are increasingly scrutinizing risk factors, meaning that tow truck operators must maintain rigorous operational safety standards. The fine print of liability coverage can also include clauses addressing unique risks like equipment failure and third-party property damage. Operators should understand every exclusion to avoid coverage gaps, ensuring that their financial interests are safeguarded against unforeseen litigation.

It's also critical to note that many personal injury law firms in Texas focus solely on injury claims and advise clients to handle property damage independently-a trend affecting claim outcomes for accident victims. With 92% of such firms reportedly omitting property damage services (), the need for comprehensive liability coverage is even more pronounced for tow truck companies.

Physical Damage and Equipment Coverage

Physical damage coverage, which includes protections for the tow truck and accompanying equipment, is another crucial pillar of a robust insurance program. Operators must account for risks not just from accidents but also from incidents like theft, vandalism, and natural disasters. Since the occupational environment involves exposure to harsh weather and demanding road conditions, ensuring your equipment is effectively covered prevents costly repair bills and operational downtimes.

This type of coverage typically extends to collision and comprehensive policies that address various scenarios. With repair costs potentially escalating due to extensive damages, understanding policy limits and deductibles is essential for maintaining stable business operations.

Tow truck operators should review their coverage annually or after any significant business changes to ensure alignment with current market valuations and potential catastrophic risks.

Impacts of Litigation Trends on Insurance Premiums

Several factors influence insurance premiums, including the legal environment in which tow truck operators work. Litigation trends in Texas, underscored by aggressive legal tactics and claims strategies, significantly affect the cost of coverage.

Insurance companies note that the intense litigious climate in Texas contributes to rising premiums. According to Dana C. Moore, Vice President of Policy and Governmental Relations at the Texas Trucking Association (), these premiums are driven by concerns over excessive litigation and the potential for large damage awards.

For tow truck operators, understanding these pressures is vital. When operating in an environment where nearly all claims are scrutinized under the lenses of litigation risk, reviewing policy language concerning indemnification and defense liability becomes crucial. This review ensures that coverage remains adequate in light of ongoing legal challenges.

Safety Innovations and Risk Mitigation Strategies

Improving safety not only reduces premiums but also contributes to overall risk mitigation. Recent studies on Truck Mounted Attenuators (TMAs) in mobile work zones highlight the potential for proactive warning systems to improve roadside safety (). While field tests are ongoing, this research underscores the importance of technology-driven safety measures, especially for companies operating tow trucks in busy interstate corridors.

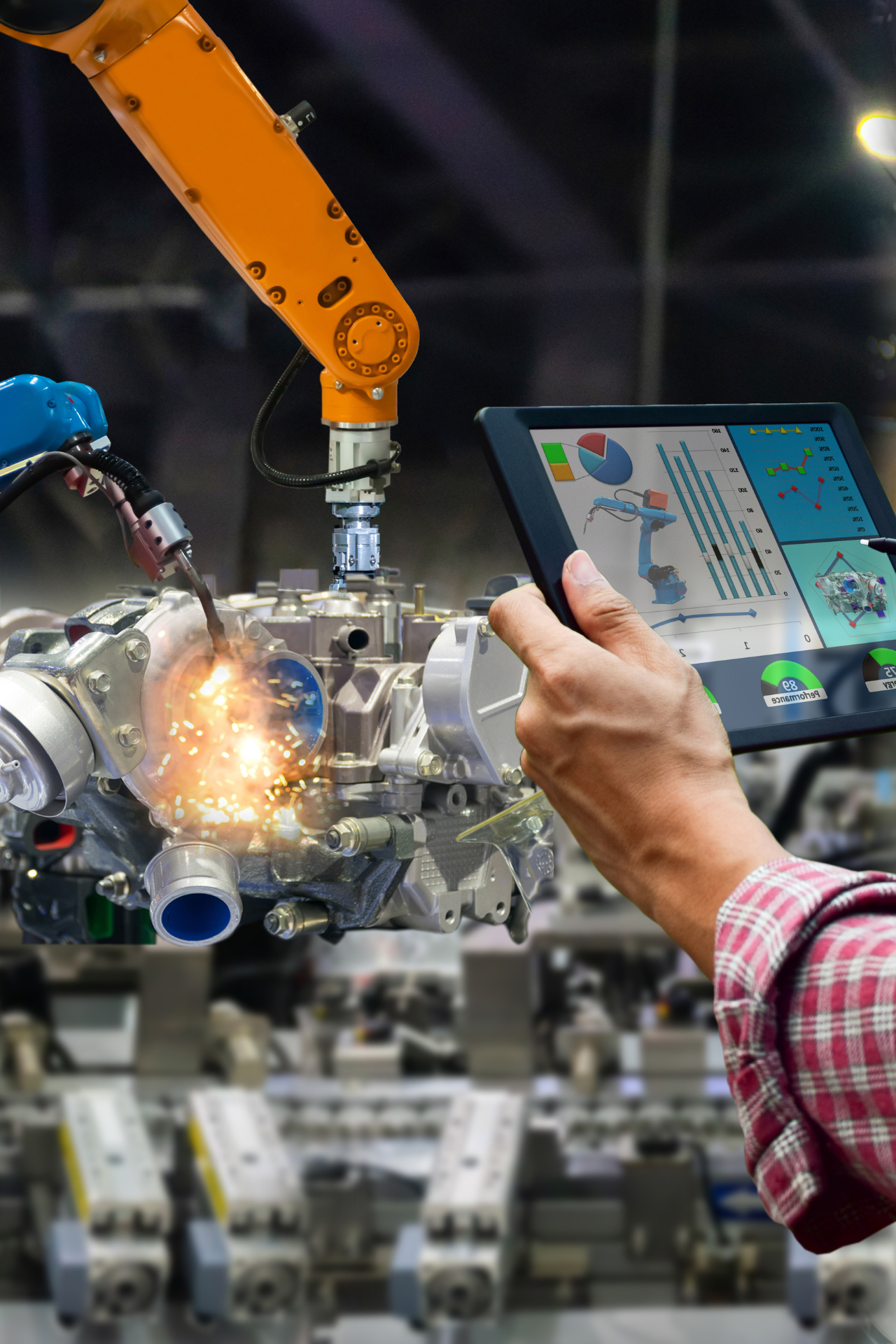

Innovations, such as integrated telematics and on-board cameras, help monitor driving behaviors. These systems track speed, abrupt braking, and other risky maneuvers in real time. Insurance carriers increasingly offer premium discounts for operators who invest in such safety enhancements. Additionally, training programs emphasizing defensive driving techniques can further reduce the frequency and severity of accidents.

Adopting safety technologies not only shields operators from potential claims but also adds a layer of assurance to clients. This dual benefit can lead to lower insurance costs while enhancing overall operational efficiency. As insurers increasingly focus on preventing accidents rather than merely compensating for them, proactive risk management strategies emerge as a key competitive advantage.

Customized Coverage for Diverse Scenarios

One size does not fit all in the world of tow truck insurance. Customization options can help tailor policies to meet the specific risks tied to various operational scenarios. Coverage options might include endorsements for off-road recovery services, roadside assistance, or even bundling with commercial auto policies for expanded protection.

Operators should work closely with insurers to identify potential exposures unique to their business. Understanding detailed policy components can prove crucial when it comes time to file a claim. Ensuring that the policy covers both property damage and bodily injury claims can safeguard against the sort of cost burdens seen when claims are handled piecemeal.

It’s beneficial to compare policies not only based on premium costs but also on the breadth of coverage offered. Some insurers may include additional services like legal defense coverage or accident management support. Such add-ons can be invaluable in mitigating the financial risks associated with high litigation rates and property damage claims.

Bundling Services for Enhanced Protection

Bundling multiple coverage types under one policy can offer significant advantages. Combining commercial auto liability with general liability and equipment coverage streamlines claims processing while potentially reducing overall premiums. Insurance providers are increasingly supporting bundled packages as a way to provide holistic protection coupled with policy simplicity.

This approach proves particularly effective in Texas, where both high litigation rates and frequent truck accidents create a challenging risk environment. Bundling coverage ensures that there are no unexpected gaps between policies when an accident occurs, thus providing a smoother claims process during stressful situations.

Operators considering bundling should conduct a comprehensive review of their risk exposures. A well-bundled policy not only simplifies administrative tasks but also helps maintain operational continuity in the face of major claims or judicial actions.

Legal and Regulatory Considerations

Legal frameworks in Texas create both opportunities and challenges for tow truck operators. The aggressive litigation tactics adopted by some personal injury law firms have led to significant economic impacts. One startling statistic from industry insights suggests that accident victims in Texas are losing nearly $1.34 billion annually in property damage settlements due to legal practices that leave clients handling vehicle damage claims independently ().

This shift puts pressure on insurers to structure policies that adequately protect operators while managing their own exposure to large payouts. The absence of property damage handling by many law firms forces operators to be better prepared with comprehensive coverage that addresses both direct and indirect costs of an accident.

Policy makers also take an active role in shaping the legal landscape. Industry bodies, like the Texas Trucking Association, have been advocating for lawsuit abuse reform, focusing particularly on capping damages in truck-involved crashes (). Regulatory changes aimed at limiting excessive litigation awards could ease the financial burden on tow truck operators and help stabilize premium rates over time.

| Policy Type | Coverage | Average Annual Premium | Key Benefits |

|---|---|---|---|

| General Liability | $500,000 bodily injury & property damage; $1,000,000 annual aggregate | $670 | Covers third-party claims; protects against damages during operations |

| Workers' Compensation | Covers medical and wage-related expenses for employee injuries | $1,710 | Ensures employee safety net; legally required and critical for workforce protection |

| Additional Coverages | Optional: Pollution, Product Liability | Varies | Provides extra layers of protection; covers cleanup and environmental claims |

The Business Impact of Insurance Decisions

The insurance choices made by tow truck companies have long-lasting operational and financial implications. Decisions regarding coverage levels, policy customization, and safety technology investments all play a role in overall business performance. With a declining sector profitability evidenced by a -3% 10-year return on net worth in commercial auto liability insurance in Texas (), operators must weigh cost concerns against the benefits of more comprehensive protection.

When incidents occur, timely and adequate insurance coverage can mean the difference between a manageable claim and a crippling financial setback. A well-designed insurance program can help companies quickly return to business after an accident. In addition, transparent communication with insurers regarding operational risks and changes in the business model often results in more favorable coverage terms and premium adjustments.

Ultimately, tow truck operators should view their insurance decisions as integral components of their overall risk management strategy rather than mere administrative requirements. In this competitive market, having strong insurance coverage not only protects assets but also enhances company reputation among clients and stakeholders.

Comparison Chart: Key Coverage Options for Tow Truck Operators

The following table offers a side-by-side look at several essential coverage components that are beneficial for tow truck operators. It highlights the core aspects of each option, allowing operators to quickly discern the benefits of a bundled approach.

| Coverage Type | Key Benefits | Considerations |

|---|---|---|

| Liability Coverage | Protection against bodily injury and property damage claims | Essential due to rising litigation pressures and accident rates |

| Physical Damage Coverage | Covers repair or replacement of tow truck and equipment | Important in high accident and vandalism risk zones |

| Bundled Policy Options | Simplifies claims, potentially reduces premiums | Review for coverage gaps; ensure all exposures are addressed |

| Safety Technology Discounts | Incentives for installing telematics and advanced safety systems | Investment in technology upfront can reduce long-term costs |

| Legal Defense Coverage | Coverage for legal expenses arising from litigation | Key given Texas' aggressive litigation environment |

Each tow truck operator should review their individual needs against this checklist. Bundling coverage can provide comprehensive protection while maintaining cost-effectiveness in a dynamic legal and operational landscape.

Integrating Safety Initiatives with Insurance Strategy

Safety initiatives have a direct impact on insurance premiums and claim frequencies. Operational changes like implementing Truck Mounted Attenuators (TMAs) play a role in proactive risk management. Even though field tests for TMAs in mobile work zones are still being conducted (), their potential to alert oncoming traffic and buffer impact zones cannot be overlooked.

In addition to technology, routine safety training for drivers is a proven method to reduce accident frequency. Operators who invest in driver training see measurable improvements in both safety performance and premium reductions. This dual benefit aligns well with the overall goal of risk management, creating a smoother relationship with insurers and often leading to favorable adjustments in coverage costs.

It is advisable for operators to adopt a culture of continuous improvement. Probability of accidents decreases when both technology and human factors converge to improve overall safety. Safety initiatives also serve as a valuable selling point for customers, who seek assurance that their service provider is investing in proactive risk mitigation.

Ensuring Comprehensive Claims Management

Efficient claims management is a critical part of maintaining business continuity. Given the high frequency of accidents and the nuanced challenges of Texas litigation, tow truck operators must prepare for claims with both robust internal protocols and supportive insurer networks. A well-organized claims process can ease the financial and operational strain following an incident.

Many tow truck companies prioritize immediate damage assessments and clear reporting procedures. The tendency for personal injury law firms to focus exclusively on injury claims, leaving property damage to the client (), only reinforces the need for a meticulous internal claims management system. This is especially important for addressing any property-related damages rapidly and ensuring that repair and replacement costs do not spiral out of control.

Operators should set up clear communication channels with their insurers to expedite claims and reduce downtime. A proactive approach that includes regular training on accident protocols and routine updates to claims procedures should be regarded as an essential part of the overall risk strategy.

Regulatory and Compliance Landscape in Texas

The regulatory environment in Texas is as dynamic as its roadways. Laws and litigation trends continue to evolve, making it imperative for tow truck operators to remain updated on current requirements. For instance, calls for lawsuit abuse reform, which aims to cap damages in truck-involved crashes, have been a focal point among industry stakeholders (). Such reforms could eventually ease the financial pressures borne by insurers and, by extension, lower premium rates for operators.

Compliance with state regulation not only aids in risk management but also ensures that the operators’ business practices are in line with best practices. Regular audits and updates to insurance coverage in response to changing legal standards can minimize undue exposure during litigation. Staying current with policy changes and engaging in active dialogues with both legal experts and insurance representatives is a recommended practice for any tow truck operator.

Moreover, regulatory bodies often provide updated guidelines that reflect the latest in risk management methodologies. Operators who align themselves quickly with these evolving standards often find it easier to negotiate better insurance terms.

Strategies for Managing Premium Costs

Premium management is always a top concern. As the market for commercial auto insurance in Texas experiences turbulent financial returns, operators need strategies that balance coverage necessities with cost-efficiency. This balance is especially critical given the increased risk exposure from frequent truck accidents and the potential for costly litigation.

Risk mitigation through safety programs and proactive accident management can yield favorable premium evaluations from insurers. Additionally, engaging in bundled policy packages offers financial relief. Careful selection of deductibles in alignment with reserve cash flows is another tactic that can help stabilize out-of-pocket expenses when claims are filed.

Operators are encouraged to perform a periodic review of their claims history and work with independent insurance experts to conduct market comparisons. Such measures can identify both over-insured and under-insured areas, ensuring that premium costs remain proportionate to the actual risk exposure.

Evaluating the Insurance Market in Texas

Market dynamics for property and casualty insurance are not static. In Texas, shifts in written premiums and coverage requirements continuously prompt reassessment among carriers and operators alike. The Texas Property & Casualty Insurance Market Report noted $83.1 billion in direct written premiums in 2024, with personal auto insurance accounting for roughly $35.2 billion (). Such figures reveal the scale and complexity of the insurance market in the state.

In this context, tow truck operators find themselves in a niche position requiring both broad coverage from established carriers and specialized risk management strategies. The interplay between rising litigation claims and evolving safety standards continues to shape premium structures in an environment that demands both vigilance and adaptability.

Market analysts suggest that operators review annual market reports and engage industry-specific advisors who understand the nuances of towing and commercial auto operations. This proactive approach can lead to more favorable negotiations when renewing policies or adjusting coverage limits.

Frequently Asked Questions

This section addresses common queries from tow truck operators and business owners regarding insurance coverage and risk management strategies in Texas.

Q1: Why are insurance premiums for tow truck operators rising in Texas?

Premiums are rising due to an increasing number of truck accidents, aggressive litigation practices, and the financial pressures on insurers shown by negative trends in commercial auto liability profitability ().

Q2: What does a bundled insurance policy offer?

A bundled policy combines different types of coverage, such as liability, physical damage, and legal defense, into one package. This approach simplifies claims processing and often results in cost savings.

Q3: How can technology lower my insurance premiums?

Investing in safety technologies like telematics and advanced warning systems can demonstrate proactive risk management, which many insurers reward with lower premiums ().

Q4: What should operators do to ensure comprehensive claims management?

Operators should establish clear incident reporting protocols, work regularly with their insurer, and update their internal policies to expedite claims processing in the wake of an accident.

Q5: How does the legal climate in Texas affect tow truck insurance?

The aggressive litigation environment in Texas, including trends such as law firms limiting property damage claims handling (), drives insurers to price in higher risks, resulting in increased premiums.

Q6: What role do safety initiatives like TMAs play in reducing risk?

Safety initiatives such as Truck Mounted Attenuators (TMAs) help decrease accident severity by providing proactive warnings, potentially reducing both the frequency of claims and overall risk exposure.

Final Thoughts: Balancing Risk and Protection in a Complex Market

The decision to invest in robust insurance coverage is fundamental for tow truck operators navigating Texas’ demanding operational and legal environments. The interplay between aggressive litigation, evolving technologies, and market dynamics calls for a well-thought-out approach to risk management.

Ensuring that policies are regularly reviewed, safety programs are actively implemented, and compliance with evolving regulatory standards is maintained will help secure both financial protection and operational integrity. As market pressures continue to evolve, operators who take a proactive and informed approach can manage risks more effectively while optimizing their insurance expenditures.

For those looking to refine their coverage, keeping up with market reports, engaging with industry experts, and considering bundled policies may offer the best route to achieving a balanced insurance strategy. With a clear understanding of both the opportunities and the challenges facing the industry today, tow truck operators can make better decisions that ultimately lead to sustained business performance.

About The Author: Mark Braly

As President & CEO of Braly Insurance Group, I’ve built my agency since 1997 on the promise of protecting what matters most for families and businesses across Texas.

With a finance degree from Oklahoma State University and nearly three decades in the industry, I lead a team that offers tailored, local insurance solutions—whether it’s specialized commercial coverage or personal protection.

Outside the office, you’ll find me on the golf course or playing piano, always energized by time with my family and my commitment to giving back through organizations like CASA McKinney.

Testimonials

Real Insurance Clients with Honest Reviews

Braly agency was very honest and professional to work with. They have many resources to choose from and are a full service Insurance Agency. I highly recommend! Caden provided excellent and knowledgeable service throughout the process.

Louis G.

Insurance Client

I have been with the Braly Group for years. Their attentiveness gratitude and all around a good group to take care of your insurance and others needs.

Thanks for being amazing,

Jeff D.

Insurance Client

I have been with the Braly Insurance Group for over 10 years! Absolute professionals who definitely take care of you personally. I trust the Braly Group to give me the best product and price for my insurance needs!

Doug F.

Insurance Client

Everyone at Braly Insurance is always friendly & helpful. Whether you need to file a claim or make changes to your policy they are there to help with whatever you need.

Terry B.

Insurance Client

Business Insurance

Commercial Insurance Policies

General Liability Insurance

Comprehensive protection against lawsuits and other common business risks.

Workers Comp Insurance

Coverage for medical expenses and lost wages due to workplace injuries.

Commercial Property Insurance

Protect your business property from damage, theft, and natural disasters.

Commercial Auto Insurance

Insurance for vehicles used in your business operations, covering accidents and damages.

Professional Liability Insurance

Protection against claims of negligence, errors, and omissions in your professional services.

Industry-Specific Insurance

Businesses We Serve

FAQs

Frequently Asked Question About Braly Insurance Group

What's the difference between an independent insurance agent and a captive agent?

Independent insurance agents, like those at Braly Insurance Group, offer a wide range of insurance products from multiple companies, allowing them to compare policies and find the best fit for your needs. Captive agents are tied to a single insurance company and can only offer products from that provider. Choosing an independent agent in Texas provides access to a broader selection of options, ensuring a more personalized and cost-effective insurance solution.

Why should I choose an independent insurance agent in Texas?

Opting for an independent insurance agent in Texas means receiving personalized, unbiased advice across a wide spectrum of insurance options. Independent agents source policies from multiple companies, tailoring coverage to your specific needs, often at more competitive prices. They possess a thorough understanding of local insurance requirements and risks, ensuring your coverage is both comprehensive and relevant to Texas.

What are the typical insurance types offered by independent agents in Texas?

Independent agents in Texas typically provide a broad range of insurance types, including homeowners, auto, life, and umbrella policies, as well as specialized coverage like motorcycle and condo insurance. They offer customized solutions for various situations, ensuring you have access to policies that match your specific needs, whether you're protecting your family, home, vehicle, or personal assets.

What's the cost to collaborate with an independent insurance agent in Texas?

Engaging with an independent insurance agent in Texas usually doesn't involve any direct costs or fees for their advisory services. Agents earn commissions from the insurance companies for the policies they sell, allowing you to benefit from their expertise and personalized service without incurring additional expenses. Their objective is to secure the best coverage for you at the most competitive rates, aligning with your financial and insurance needs.

Why should I partner with a local independent insurance agent?

Partnering with a local independent insurance agent offers numerous advantages. They have a profound understanding of Texas' unique insurance needs and challenges, providing advice and solutions tailored to the local context. Local agents are readily available for face-to-face meetings, offering a level of personalized service that larger, non-local agencies can't match. Their commitment to the community means they're dedicated to finding the best insurance solutions for their neighbors, adding a personal touch to their professional services.

Personal Insurance options

Our Complete Range of Personal Insurance Solutions

Home Insurance

Protect your home with comprehensive coverage tailored to your needs. Secure your peace of mind today.

01

Car Insurance

Drive confidently with our customizable auto insurance plans designed for every driver and vehicle.

02

Boat Insurance

Enjoy your time on the water with our reliable boat insurance, covering damages and liabilities.

04

RECENT POSTS

Get the Latest Updates

Contact Us