Texas used car dealers face a complex landscape where insurance requirements, compliance rules, and market conditions interact. Dealers must understand local regulations as well as market trends to operate successfully. This guide presents the essential insurance coverage options, compliance matters, and risk management strategies that used car dealers in Texas should know. For instance, recent industry developments have impacted everything from monthly auto insurance premiums to data privacy practices. Learn more about current auto insurance trends here.

Dealer owners need actionable data and practical advice. Texas stands out for its unique regulatory environment and market behavior. Whether it’s understanding liability limits or addressing deceptive sales practices, this guide dives into several critical aspects that every dealer must consider, backed by recent statistics and expert insights.

Understanding Insurance Requirements for Texas Used Car Dealers

Texas insurance regulations require used car dealers to secure coverage that protects against liabilities and business risks. The Texas Department of Insurance (TDI) specifies minimum requirements that serve as the foundation for compliance. These include motor vehicle liability insurance with set minimums: $30,000 for bodily injury per person, $60,000 per accident, and $25,000 for property damage. Dealers may also use surety bonds, cash deposits, or self-insurance to meet financial responsibility standards as outlined by the TDI.

Compliance is not simply checking off boxes. Dealers must ensure that each vehicle on the lot is adequately covered and that all transactions meet state standards. The stakes become even higher considering rising auto insurance rates. In 2024, average monthly premiums for auto insurance in Texas spiked to nearly 125% of the national average, reaching an average of $245 (InsuraSales).

The complexity of coverage issues means that auto dealers must balance their operational processes with robust insurance practices. Failure to comply can lead to substantial financial penalties and even suspension of licenses.

Risk Management Strategies for Used Car Dealers

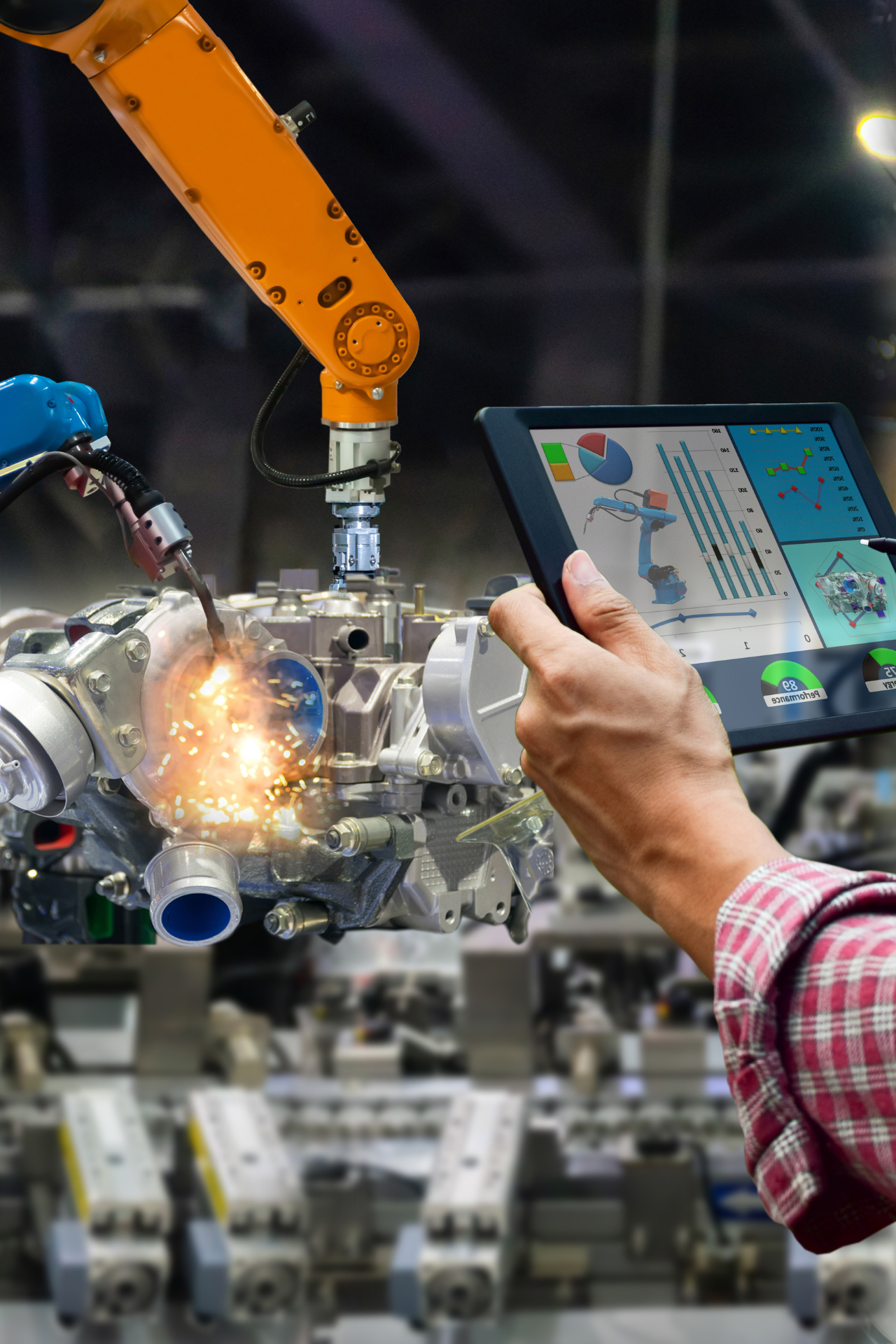

Managing risk in the used car dealership field involves both adequate insurance and proactive business practices. Dealer owners should work with experts who understand Texas-specific regulatory requirements. They must assess risks such as property damage, bodily injury, and liability claims while developing robust internal controls for data privacy and sales practices.

Insurance is one pillar of risk management, but dealerships need a holistic view that includes operational efficiency, secure data handling, and vigilant compliance reviews. Recent legal actions, such as the lawsuit against General Motors for unauthorized data collection, serve as a reminder that data privacy intersecting with insurance can quickly become a legal issue (Texas Attorney General's Office). Maintaining secure customer data protects both the dealer and the consumer, reducing the risk of litigation and reputational harm.

Risk management best practices include regular audits of internal procedures, rigorous training for sales teams, and a clear breakdown of insurance coverages tailored to every aspect of the dealership's operation. Even small procedural errors can lead to claims that might exceed coverage amounts if left unchecked.

Impact of Rising Insurance Costs on Dealerships

Texas has experienced a significant surge in insurance rates which affects both direct costs and the broader financial landscape for used car dealers. A recent report noted that monthly insurance premiums reached an average of $245 in the state. Such increases can pressure profit margins and influence pricing strategies on the sales floor (InsuraSales).

The rise in premiums not only reflects general market trends but also the unique risks associated with Texas, such as severe weather conditions and high traffic volumes. Dealers must be proactive in examining their coverage options, comparing quotes, and ensuring that policy details match the scope of business operations.

For many dealerships, the decision to limit coverage often pits cost against protection. Dealing with rising premiums means evaluating extended coverage options and negotiating better terms with insurers. A dealer who underestimates this risk may find themselves facing substantial out-of-pocket liabilities during an adverse event.

Compliance Issues in Texas Used Car Dealerships

Compliance challenges for used car dealers created by regulatory requirements are both extensive and highly detailed. Dealers are mandated to adhere not only to insurance minimums but also to ethical sales practices and data privacy laws. Recent findings by the Texas Department of Insurance illustrate that while appraisal is rarely used in personal auto claims, over 94% of claims are initiated directly by claimants (Repairer Driven News).

Instances of repeated violations can tarnish a dealership's reputation and result in regulatory penalties. A notable example is Strawberry Road Auto Sales in Pasadena, Texas. Records show that the dealership accumulated 46 violations dating back to 2019, including deceptive sales practices and misuse of buyer e-tags (Click2Houston). Such infractions can lead to stricter oversight and loss of consumer confidence, creating long-term operational challenges.

Dealers should institute regular compliance audits to catch potential issues before they escalate. Integrating training modules focused on ethical behavior, sales transparency, and regulatory updates can help maintain high standards and avoid legal pitfalls.

Used car dealers have a variety of insurance options available. Besides mandatory motor vehicle liability insurance, several add-on coverages can protect against unique risks. These might include general liability, property insurance, and workers’ compensation. Each of these policies addresses different facets of running a car dealership, from physical risks to employee injuries.

For many dealers, guaranteeing financial stability also involves exploring alternative ways to demonstrate financial responsibility. Options like surety bonds and cash deposits can sometimes offer a more flexible solution compared to traditional insurance policies (TDI Report).

Integrating expanded coverage might appear costly initially, but it can prevent larger losses in the event of unexpected claims. Each dealer should weigh the benefits of comprehensive protection against the operating budget and risk exposure associated with daily business activities.

Regulatory Environment & Legal Considerations

Used car dealerships in Texas operate under a strict regulatory framework. Legal requirements involve clear disclosure of vehicle history, accurate advertising practices, and adherence to both state and federal laws. Beyond insurance, failing to comply with these legal standards can lead to civil lawsuits and state-imposed fines.

A recent legal case highlights the potential perils of overlooking compliance. In August 2024, Texas Attorney General Ken Paxton filed a lawsuit against a major automotive manufacturer for unlawfully collecting and selling personal driving data without consent (Texas Attorney General's Office). The implications for dealerships, particularly those handling client data, are profound. Ensuring informed consent and transparent data practices is essential.

Dealerships must also be mindful of consumer protection statutes which protect buyers against deceptive practices. Regular legal consultations and participation in industry groups can keep dealers updated on regulatory changes. This proactive approach reduces legal vulnerabilities and ensures that all operations adhere to the latest standards.

Understanding Local Market Trends

Dealership owners in Texas not only contend with regulatory and insurance issues but must also navigate market trends. Recent studies indicate the Texas used-car market remains robust, with average retail prices reported at approximately $30,934-surpassing the national average of about $29,383 (Ashton Agency). These higher price points reflect several market forces, including local demand and economic conditions.

The price differential creates both opportunities and challenges. Higher vehicle values can result in larger profit margins per sale, but they also require substantial attention to risk management. Insurance premiums and liability coverage must keep pace with these market values, ensuring that potential losses are mitigated.

Monitoring local market trends can help dealers set competitive prices and adjust marketing strategies while staying compliant with insurance demands and regulatory frameworks.

Practical Steps for Enhancing Compliance and Coverage

Used car dealers must adopt a tactical approach to maintain both comprehensive coverage and full regulatory compliance. One practical step is to develop a combined strategy that integrates regular internal audits with ongoing training sessions. These reviews should encompass everything from sales practices and customer data management to the specific terms of required insurance policies.

Dealers can utilize checklists and compliance timelines to ensure all necessary documentation and renewals are current. This is particularly important for meeting annual or biennial audits conducted by regulatory bodies like the TDI.

Integrating technology can streamline compliance tracking. Digital tools and management dashboards can alert dealers to upcoming policy expirations and required updates. This technology-driven approach minimizes human error and provides a clear overview of the dealership’s risk profile.

Developing an Internal Compliance Program

Creating an internal compliance program is a proactive measure that all dealerships should consider. The program should cover key areas such as ethics training, sales transparency, and data protection. Dealers can design training modules that explain both state regulations and internal protocols, ensuring every team member understands their responsibilities.

A well-crafted program reinforces the importance of adherence to established standards. It also serves as documentation that due diligence has been exercised, which can be invaluable during audits or legal reviews. Establishing a clear chain of accountability within the organization also aids in quickly addressing any potential issues before they escalate.

Documentation of compliance efforts is necessary not only for regulatory purposes but also for building trust with customers. Transparent operations can differentiate a dealership from competitors, fostering customer loyalty and a strong reputation in the market.

Enhancing Insurance Coverage Through Regular Reviews

Periodic reviews of insurance policies help dealers adjust coverage levels to match evolving risks. Insurance needs may shift due to changes in inventory value, fluctuating market prices, or increased regulatory scrutiny. Scheduling regular insurance evaluations-at least annually-ensures that policy limits remain adequate and competitive.

During these reviews, dealers should verify that premiums, deductibles, and coverage sections align with current business operations. Dealers may find opportunities to negotiate better rates or adjust coverage categories, providing added financial safety. Consulting with an insurance specialist who understands the nuances of the used car market in Texas is a wise strategy.

This proactive approach not only reduces the risk of underinsurance but also minimizes the chance of unexpected costs down the line. In an environment where average premiums are notably high, such vigilance can yield significant long-term savings and enhanced financial stability.

Charting the Insurance Coverage Options

The insurance options available to used car dealers in Texas can be broadly compared using a side-by-side chart. This chart delineates basic coverage requirements versus extended risk management options, helping dealers make informed decisions on policy adjustments.

The chart below compares standard motor vehicle liability insurance with comprehensive insurance solutions that include general liability, property insurance, and add-on coverages such as data breach or cyber protection. This visual guide simplifies the decision-making process in light of rising insurance costs and compliance needs.

| Coverage Type | Standard Motor Vehicle Liability | Comprehensive Dealer Insurance |

|---|---|---|

| Bodily Injury | $30,000 per person, $60,000 per accident (TDI Report) | Customized limits to cover extended risks |

| Property Damage | $25,000 per accident | Enhanced limits covering property and inventory |

| General Liability | Not included | Protection against accidents on premises |

| Data Breach/Cyber Protection | Not included | Optional add-on for securing digital information |

| Additional Options | Traditional self-insurance, surety bonds | Bundled risk management packages with tailored coverage |

This chart provides an at-a-glance comparison that underlines the flexibility available to dealers. The extra investment in comprehensive coverage not only meets regulatory requirements but also offers greater security against unforeseen losses.

Data privacy challenges are increasingly prominent in the automotive sector. Recent regulatory attention on data breaches and unauthorized data collection has pushed dealers to adopt more rigorous privacy protocols. Data collected during vehicle purchases must be stored and managed with strict compliance to privacy laws.

For instance, the lawsuit against General Motors for unlawfully collecting and selling private driving data emphasizes the importance of handling sensitive information correctly (Texas Attorney General's Office). A robust data management policy not only protects customer privacy but also reinforces the dealer's reputation for trustworthiness.

Dealers should integrate technology solutions that encrypt sensitive data and automate compliance reporting. This not only limits exposure during a data breach but also ensures that every step in the sales process maintains transparency and security.

Financial Planning and Cost Management

Insurance costs constitute a significant part of operating expenses for used car dealerships. Rising premiums have a direct impact on the bottom line, making strategic financial planning essential. Dealers must balance the need for comprehensive coverage with the realities of operational costs, particularly as insurance rates in Texas average nearly 125% of the national premium rates (InsuraSales).

One approach is to perform cost-benefit analyses for various insurance packages. This strategy involves comparing the risks associated with lower premiums against the exposure of significant out-of-pocket liabilities. Reviews of historical claims data and market trends aid in making these complex decisions.

Effective financial planning also means incorporating contingencies for unforeseen events. An unexpected claim or regulatory penalty can disrupt cash flow, so maintaining a reserve fund or purchasing additional coverage can provide safety nets during challenging periods.

Given the frequent changes in regulations and market conditions, staying informed is vital for all used car dealers. Regular participation in industry conferences, webinars, and local business groups enables dealers to keep up-to-date with current trends and compliance issues. Educational events offer a chance to exchange practical experiences and learn about emerging risks from peers and experts.

Training sessions focused on regulatory updates, insurance innovations, and market analysis are essential for any dealership aiming to grow sustainably. In addition, dealers may consider subscribing to industry publications and online resources that offer timely breakdowns of market conditions and legal reforms.

This ongoing education helps cultivate a proactive approach. Whether updating internal compliance protocols or negotiating better insurance terms, knowledge empowers dealers to make decisions that drive long-term success.

Frequently Asked Questions

This section provides answers to common questions Texas used car dealers might have about insurance coverage, compliance, and market trends.

Q: What are the minimum insurance coverage requirements for Texas used car dealerships?

A: Dealers must have motor vehicle liability insurance with coverage limits of $30,000 per person for bodily injury, $60,000 per accident, and $25,000 for property damage (TDI Report).

Q: How do rising insurance premiums affect dealership operations?

A: Increased premiums, such as the 2024 average of $245 per month in Texas, squeeze profit margins and necessitate careful budget adjustments (InsuraSales).

Q: What steps can be taken to ensure compliance with regulatory requirements?

A: Establish thorough internal audit processes, emphasize employee training, and stay updated with current legal standards to maintain compliance.

Q: Can alternative methods like surety bonds satisfy Texas financial responsibility requirements?

A: Yes, Texas allows dealers to use surety bonds, cash deposits, or self-insurance as valid methods for demonstrating financial responsibility (TDI Report).

Q: What are the risks of ignoring data privacy in dealership operations?

A: Improper handling of sensitive data can lead to legal action, as seen in cases where unauthorized data collection resulted in lawsuits (Texas Attorney General's Office).

Q: How can ongoing education and training benefit a used car dealership?

A: Continuous learning through industry events and updated training ensures that dealer teams remain informed, allowing them to adjust practices promptly to regulatory changes and market shifts.

Before You Go

Texas used car dealerships must navigate a challenging but manageable landscape of insurance requirements, market trends, and compliance rules. Establishing a robust strategy in risk management, continuous compliance verification, regular insurance reviews, and ongoing education enables dealers not only to meet regulatory requirements but also to thrive within the competitive Texas market.

Dealers operating within the state should consider the broader implications of rising insurance premiums, recent legal developments, and the essential integration of technology in both compliance and risk management practices. Thorough planning and a proactive attitude toward internal training and technology adoption can make a significant difference.

Remaining vigilant and informed is critical to adapting to the ever-changing environment. The balance between ensuring coverage and maintaining a cost-effective business model is a continuous challenge that demands careful attention, regular updates, and strategic foresight.

About The Author: Mark Braly

As President & CEO of Braly Insurance Group, I’ve built my agency since 1997 on the promise of protecting what matters most for families and businesses across Texas.

With a finance degree from Oklahoma State University and nearly three decades in the industry, I lead a team that offers tailored, local insurance solutions—whether it’s specialized commercial coverage or personal protection.

Outside the office, you’ll find me on the golf course or playing piano, always energized by time with my family and my commitment to giving back through organizations like CASA McKinney.

Testimonials

Real Insurance Clients with Honest Reviews

Braly agency was very honest and professional to work with. They have many resources to choose from and are a full service Insurance Agency. I highly recommend! Caden provided excellent and knowledgeable service throughout the process.

Louis G.

Insurance Client

I have been with the Braly Group for years. Their attentiveness gratitude and all around a good group to take care of your insurance and others needs.

Thanks for being amazing,

Jeff D.

Insurance Client

I have been with the Braly Insurance Group for over 10 years! Absolute professionals who definitely take care of you personally. I trust the Braly Group to give me the best product and price for my insurance needs!

Doug F.

Insurance Client

Everyone at Braly Insurance is always friendly & helpful. Whether you need to file a claim or make changes to your policy they are there to help with whatever you need.

Terry B.

Insurance Client

Business Insurance

Commercial Insurance Policies

General Liability Insurance

Comprehensive protection against lawsuits and other common business risks.

Workers Comp Insurance

Coverage for medical expenses and lost wages due to workplace injuries.

Commercial Property Insurance

Protect your business property from damage, theft, and natural disasters.

Commercial Auto Insurance

Insurance for vehicles used in your business operations, covering accidents and damages.

Professional Liability Insurance

Protection against claims of negligence, errors, and omissions in your professional services.

Industry-Specific Insurance

Businesses We Serve

FAQs

Frequently Asked Question About Braly Insurance Group

What's the difference between an independent insurance agent and a captive agent?

Independent insurance agents, like those at Braly Insurance Group, offer a wide range of insurance products from multiple companies, allowing them to compare policies and find the best fit for your needs. Captive agents are tied to a single insurance company and can only offer products from that provider. Choosing an independent agent in Texas provides access to a broader selection of options, ensuring a more personalized and cost-effective insurance solution.

Why should I choose an independent insurance agent in Texas?

Opting for an independent insurance agent in Texas means receiving personalized, unbiased advice across a wide spectrum of insurance options. Independent agents source policies from multiple companies, tailoring coverage to your specific needs, often at more competitive prices. They possess a thorough understanding of local insurance requirements and risks, ensuring your coverage is both comprehensive and relevant to Texas.

What are the typical insurance types offered by independent agents in Texas?

Independent agents in Texas typically provide a broad range of insurance types, including homeowners, auto, life, and umbrella policies, as well as specialized coverage like motorcycle and condo insurance. They offer customized solutions for various situations, ensuring you have access to policies that match your specific needs, whether you're protecting your family, home, vehicle, or personal assets.

What's the cost to collaborate with an independent insurance agent in Texas?

Engaging with an independent insurance agent in Texas usually doesn't involve any direct costs or fees for their advisory services. Agents earn commissions from the insurance companies for the policies they sell, allowing you to benefit from their expertise and personalized service without incurring additional expenses. Their objective is to secure the best coverage for you at the most competitive rates, aligning with your financial and insurance needs.

Why should I partner with a local independent insurance agent?

Partnering with a local independent insurance agent offers numerous advantages. They have a profound understanding of Texas' unique insurance needs and challenges, providing advice and solutions tailored to the local context. Local agents are readily available for face-to-face meetings, offering a level of personalized service that larger, non-local agencies can't match. Their commitment to the community means they're dedicated to finding the best insurance solutions for their neighbors, adding a personal touch to their professional services.

Personal Insurance options

Our Complete Range of Personal Insurance Solutions

Home Insurance

Protect your home with comprehensive coverage tailored to your needs. Secure your peace of mind today.

01

Car Insurance

Drive confidently with our customizable auto insurance plans designed for every driver and vehicle.

02

Boat Insurance

Enjoy your time on the water with our reliable boat insurance, covering damages and liabilities.

04

RECENT POSTS

Get the Latest Updates

Contact Us